China's Sinopec Mulls Takeover of Iraq's Gulf Keystone Petroleum

| Girish Shetti | | Dec 14, 2016 04:46 AM EST |

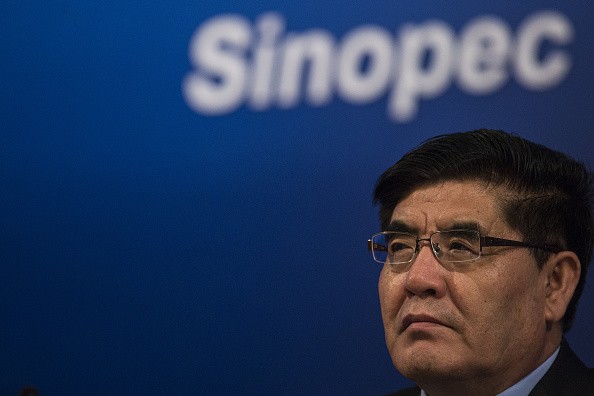

(Photo : Getty Images) Report by a leading business channel claimed that China’s state-owned oil company Sinopec is seriously thinking over buying Iraq-based energy firm Gulf Keystone Petroleum Ltd for an undisclosed amount.

China's state-owned oil company Sinopec is mulling over the proposal to acquire Gulf Keystone Petroleum Ltd., an oil-refining company based in the Kurdistan region of war torn Iraq, Bloomberg reported.

Sinopec Corp, which is Asia's largest refiner, is working with strategic advisors for the acquisition process and has already made a formal approach to Gulf Keystone, people familiar with the matter told Bloomberg.

Like Us on Facebook

Gulf Keystone has been mired in financial crisis because of low oil prices and failure to recover export payments from Kurdish regional government. The company's stressful balance sheet has had a very adverse impact on its market capitalization.

According to Reuters, the Kurdish-based oil company's current market valuation has crashed to 290 million pounds ($368 million) after Monday's trading. The firm at one point was reportedly valued more than $400 million.

Earlier this year, Gulf Keystone gave a green signal to swap its $500 million of debt for equity, resulting in huge loss for all its shareholders.

Norwegian energy firm DNO ASA in July made an acquisition offer to buy Gulf Keystone for reportedly $300 million. However, the deal could not take off as the latter failed to fulfil certain conditions related to its debt restructuring.

So far, there has been no response from either Sinopec Corp. or Gulf Keystone on the report.

Bloomberg's report claimed that Gulf Keystone has attracted interest from other bidders as well but did not reveal names of the suitors.

After the report of acquisition, Gulf Keyston stock rose 13 percent to 143 pence ($1.82) at London Stock Exchange on Tuesday morning.

TagsSinopec Corp, Gulf Keystone Petroleum Ltd, china, China and Iraq

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?