World Cup 2014: What’s In It for Investors?

| Bianca Ortega | | Jun 13, 2014 07:58 AM EDT |

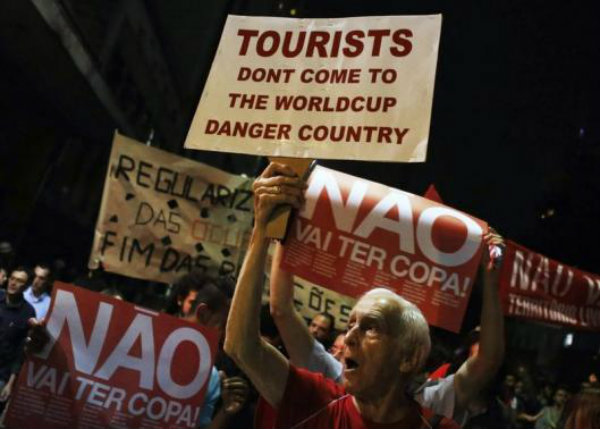

(Photo : Reuters / Nacho Doce) Demonstrators shout slogans during a protest against the 2014 World Cup, in Sao Paulo May 15, 2014.

The FIFA World Cup has already kicked off in Sao Paulo Brazil, but the economic effects of the event on the country are yet to be determined.

Based on local opinion, the World Cup 2014 is bound to produce highly negative results because events like this tend to drain the pockets of host countries. For several years already, Brazilians have been protesting against the sky-high budget on the World Cup, and they have continued with their protests until the eve of the opening day, according to Forbes.

Like Us on Facebook

Trade credit insurance firm Euler Hermes posted a report showing the World Cup and the Olympics will both add 0.2 percentage points to Brazil's 2014 GDP growth to make a 1.8% annual total. The report also said the events will bring down inflation to 6.3%.

The company argues that big events such as these usually create a lot of jobs, but not for long. In both events, the costs are underestimated all of the time, resulting in increased public debt. In Brazil's case, the cost have shot up to more than the average amount, and rumors of corruption have come up along with the increased focus on the existing poverty problem of the country.

As for infrastructure gains, there could be some, but the erected stadia could become useless later on. John Oliver has criticized World Cup organizer FIFA for allowing the stadium to be built in Manaus for a total cost of $270 million.

Oliver also said the location of the stadium is so far that it cannot be reached via car, and it will only be used for four World Cup matches, plus the place does not have a local team to use the venue after the big event. It is believed that Brazil has shelled out $11 billion to prepare for the World Cup.

As for stocks, Brazil's Bovespa index climbed 7% this year, but fell 9.76% in the last three years. The market had lost 24% in 2013.

Individual stocks are those that can benefit from the World Cup 2014. According to fund manager Bradesco Asset Management, entertainment, travel, payments, retail and hospitality firms are those that could potentially benefit the most, but still only for about a month. Moreover, the country's government bonds now offer between 6% and 7%, albeit with considerable risk.

One of the biggest effects of the World Cup on Brazilian markets will be on the government. If the tournament goes well, this could be a plus for President Dilma Rousseff if she seeks re-election this October. If not, it could be counted against her.

According to Euler Hermes, the biggest impact of the World Cup 2014 will be "deep structural reforms." If the event triggers structural change in the country, then investors could expect long-term benefits from it.

Tags2014, investors, economic impact

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?