Beijing: 'We Will not Devalue Yuan'

| Carlos Castillo | | Jan 27, 2016 04:45 AM EST |

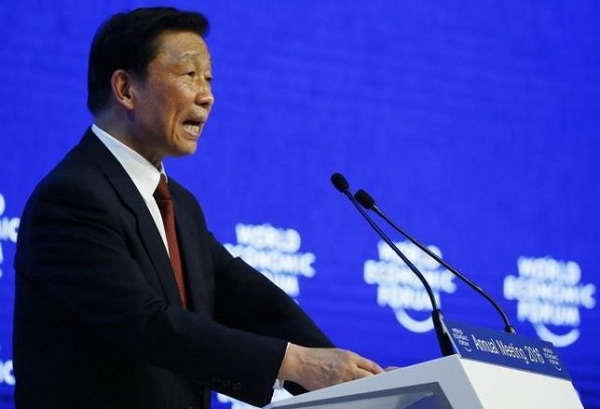

(Photo : Reuters) China's Vice President Li Yuanchao (above) has announced that the Chinese government does not intend to pursue the devaluation of the yuan.

The Chinese government has no plans to devalue the yuan, a high ranking Beijing official has said.

China's Vice President Li Yuanchao said last week Thursday that the Chinese government does not intend to pursue the devaluation of the nation's currency.

"The fluctuations in the currency market are a result of market forces, and the Chinese government has no intention and no policy to devalue its currency," Li told Bloomberg News during the World Economic (WE) Forum held in Davos last week.

Like Us on Facebook

Li made the statement even as Beijing faced mounting criticism over a widely held perception that the Chinese government has not been as forthcoming as it should be about its plans for the yuan's exchange rate.

"China isn't communicating its policy intentions in a clear manner," observed Sue Trinh, head of Asia foreign exchange strategy at the Royal Bank of Canada in Hong Kong, earlier this month. "It's disappointing that their communication policy is less than transparent."

Record Lows

Officials at the US Federal Reserve and other financial institutions around the world have been struggling to decipher China's monetary exchange policies, which affects their own economic prospects. The confusion has been a key cause of the recent turbulence in the global financial market, analysts have argued.

Chinese officials at the Davos talks are said to have had their hands full trying to allay the concerns of other participants in the conference over what has been described as Beijing's "often inscrutable" foreign exchange policies.

The yuan has been dropping against the dollar since the beginning of the year, and has hit a series of record lows along its downward trajectory. The decline has prompted some analysts to suggest that Chinese policymakers are manipulating the devaluation to buttress the country's falling exports.

Speaking at a panel discussion in Davos, Fang Xinghai, a senior economic adviser to the Chinese leadership, explained that Beijing is now committed to a new approach in which it would manage the yuan according to its performance against a basket of global currencies, as opposed to just pegging it against the US dollar.

"Communication Issue"

Beijing has for years sought stability by linking the yuan to the US dollar, allowing China to build foreign exchange reserves now valued at $4 trillion, according to the Wall Street Journal. The link has lately become untenable as the dollar has appreciated, lifting the yuan and undermining China's efforts to boost declining domestic output.

Market analysts have meanwhile noted that -- while China's economy and monetary systems have taken on a global relevance -- the People's Bank of China (PBOC) does not hold press conferences or provide public testimony on its policies. Fang's statement marked the first time a Chinese official had come forward to explain the most recent shift in China's exchange rate policy.

The PBOC has shocked global financial markets twice over the past six months by allowing steep, sudden declines in the yuan, only to step in at the last moment to stabilize the currency and discourage speculation.

International Monetary Fund (IMF) managing director Christine Lagarde -- who was on the same panel as Fang -- said that, at this point in China's economic transition, communication with the rest of the world assumes an important function.

"Given the massive transition, there is a communication issue," said Lagarde. "Better communication certainly serves the transition."

Fang agreed. "You're right, we should do a better job, and we're learning and doing it," he said. "I'm here to communicate."

Tagspeople's bank of china, global economy, Yuan Depreciation

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?