China's Mobile Payment Industry More than Tripled to $5.5 Trillion in 2016

| Prei Dy | | Feb 26, 2017 02:01 AM EST |

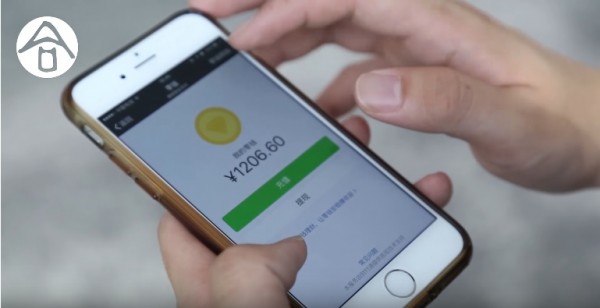

(Photo : YouTube) Third-party mobile payments in China reached $5.5 trillion in 2016.

China's booming mobile payment network more than tripled to a staggering 38 trillion yuan ($5.5 trillion) in 2016, state media People's Daily reported on Saturday.

Nearly 86 percent of Chinese consumers use their mobile apps, instead of cash or card, to buy something online. In fact, it already outpaced other countries like the US; for instance, China in 2016 recorded 200 million mobile payment users, over five times greater than the US' 37.5 million, according to a recent study by US-based global data firm Nieslen.

Like Us on Facebook

Moreover, nearly 60 percent of Chinese consumers use mobile payments to pay via mobile apps. Third-party payment apps like Alipay and WeChat turned out to become a significant part of everyday life, which allows users to shop online, pay taxes and the bills, split meal payment, and even give 'red packets' on Chinese New Year.

Alibaba's Alipay, which accounts for more than half of all Chinese mobile payments, now offers online payment and tax refund services for overseas Chinese tourists. It also promoted its "Airport of the Future" initiative, in which it partnered with airlines and airports to accommodate Chinese tourists traveling abroad. It has teamed up with local partners across the world including Europe, Southeast Asia, Japan, among others.

The significant lead of China over the US could be pointed to the country's lack of other non-cash payments available. China does not have a strong credit card culture, and debit cards are dubbed as a hassle.

Most people are lured with the convenience third-party apps gives to its clients. For instance, Alipay and WeChat only requires a QR code scanning from a retailer's terminal or smartphone to make the purchase.

Although China dominates the mobile payment growth, US is still the biggest growth driver in terms of in-person payments in offline retailers.

Tagsmobile payments, third-party payments, Alibaba, Alipay, WeChat, Tencent

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?