California Homeowners Opt Not To Have Quake Policies Despite The Presence Pf Many Active Fault Lines Along The State

| Erika Villanueva | | Aug 26, 2014 03:52 AM EDT |

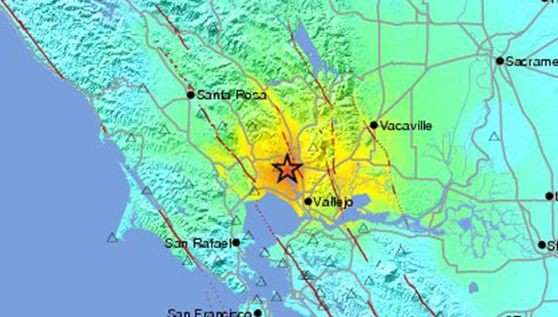

(Photo : USGS) USGS map of Aug. 24, 2014 earthquake

In spite of risks posed by active fault lines, 90 percent of Californians would not buy earthquake insurance because it costs too much.

Northern California was shook by a magnitude-6.1 quake early on Sunday, where a minimum of 176 people were injured while several structures and utility lines were destroyed.

Like Us on Facebook

However, despite the ever-present risk of devastation brought about by around 2,000 fault lines crossing the state of California, the Insurance Information Institute still found a significant drop in the number of homeowners with earthquake insurances since 2013.

Recent survey made in May 2014 shows a 12 percent decrease in Western California, leaving only 10 percent of the total number of households with quake insurance coverage.

According to the survey, people with more income are more likely to acquire the insurance coverage than those with lower income. This observation indicated that a major factor for the decrease is financial capability.

"It's expensive and major quakes happen so infrequently, it seems like a luxury more than a need," 44-year-old Napa homeowner Robert Jordan stated, citing that he would probably opt not to get an earthquake policy even if he had lived through two devastating shakers, including the 1989 Loma Prieta quake.

In Napa, less than 6 percent of homeowners bought insurance policies for earthquakes, the California Earthquake Authority stated.

California homeowners are not required to obtain an earthquake policy and, while it can be added, it is typically excluded in other homeowner insurance coverage.

Earthquake policy costs vary depending on the location and the type of house being insured. A typical California household can be said to have an average of around $860 annual payment for such insurance.

An insurance coverage for such natural disaster typically covers the house and other personal properties inside it while some offer instant cash for repairs and short-term living arrangements if the quake-stricken home is not livable after the disaster.

Tagsearthquake, Insurance, california, fault lines, earthquake insurance policy

©2015 Chinatopix All rights reserved. Do not reproduce without permission

EDITOR'S PICKS

-

Did the Trump administration just announce plans for a trade war with ‘hostile’ China and Russia?

-

US Senate passes Taiwan travel bill slammed by China

-

As Yan Sihong’s family grieves, here are other Chinese students who went missing abroad. Some have never been found

-

Beijing blasts Western critics who ‘smear China’ with the term sharp power

-

China Envoy Seeks to Defuse Tensions With U.S. as a Trade War Brews

-

Singapore's Deputy PM Provides Bitcoin Vote of Confidence Amid China's Blanket Bans

-

China warns investors over risks in overseas virtual currency trading

-

Chinese government most trustworthy: survey

-

Kashima Antlers On Course For Back-To-Back Titles

MOST POPULAR

LATEST NEWS

Zhou Yongkang: China's Former Security Chief Sentenced to Life in Prison

China's former Chief of the Ministry of Public Security, Zhou Yongkang, has been given a life sentence after he was found guilty of abusing his office, bribery and deliberately ... Full Article

TRENDING STORY

China Pork Prices Expected to Stabilize As The Supplies Recover

Elephone P9000 Smartphone is now on Sale on Amazon India

There's a Big Chance Cliffhangers Won't Still Be Resolved When Grey's Anatomy Season 13 Returns

Supreme Court Ruled on Samsung vs Apple Dispute for Patent Infringement

Microsoft Surface Pro 5 Rumors and Release Date: What is the Latest?